Every buyer has a list of wants and needs when shopping for real estate.

No home is perfect though and there's always going to be some element of compromise. As the search progresses the question becomes, "What are your deal breakers and what are you willing to bend on?"

Some buyers are willing to stretch the geographical boundaries of their search and consider locations outside of their preferred area if it means getting the size of home they want. Others are willing to give up some outdoor space in exchange for a great interior.

What about a house that's haunted?

Are there actually buyers out there who would seriously consider purchasing a property that was known to have paranormal activity?

Apparently there are. I came across a 2008 article from the Toronto Star about a Meaford, Ontario home that's haunted. At the end of the article the listing agent says he's received calls from potential buyers who tell him that, "moving into a haunted house wouldn't bother them at all."

Seriously?!

Check out the article below...

———————————————————–

Is Meaford Dream Home Haunted?

Toronto Star | By Roberta Avery | October 25, 2008

Rachael Chapman is not easily spooked.

After a fashion modelling career that took her to New York and London, Chapman, 33, travelled the world as a flight attendant before moving to a remote rural area near the Georgian Bay community of Meaford, where she lived alone in an old farmhouse with her young son, Adrian.

"We were miles from anywhere, but I wasn't at all nervous," she says.

Then last year, just before Halloween, Chapman and her partner, David MacLeod, decided to buy a home together.

The older three-bedroom, two-bathroom home they purchased for $164,000 on a tree-lined street just a few minutes' walk from downtown Meaford has a large private backyard, so it appeared to be ideal for Adrian, now 13, as well as MacLeod's 12-year-old son, Brian, and the baby the couple was expecting.

"We thought we had found our dream home," she says.

The family has not lived in the house since May, although they struggle to make the mortgage payments while paying rent on another home, she explains, while reluctantly unlocking the door.

Chapman's self-confident demeanour disappears when she steps into the kitchen that feels icy cold, although it's a warm and sunny October day. The fully furnished house is neat as a pin with children's toys tidily stacked on shelves, an empty baby's crib and family keepsakes and photographs on display.

"We left our things behind because we were scared that we would take whatever it is that's here with us," she says.

Although she loved the home at first sight, there was something about it that made her ask the realtor if anybody had died in the home, she says.

"I was assured that no one had died here," she says.

There is a ground floor master bedroom and another room they decorated as a nursery for their baby, due in January. Upstairs are the two bedrooms she thought ideal for their two boys.

"Shortly after moving into the home, we began to notice strange happenings," Chapman says.

At first the couple tried rational explanations for the loud banging noises from upstairs, which happened at times when all the family and the pets were downstairs.

"We explored the possibility that animals had taken refuge in our attic or that branches could have been rubbing against the house or rooftop, but there was no evidence of any such cause," she says.

The boys were ill at ease and refused to enter certain rooms. One said he woke to a feeling that he was being choked.

"We chalked it up to the children having vivid imaginations and talked to them at length about the inappropriate nature of their stories," she says.

Things began to escalate: appliances and lights turned themselves on and off, things went missing and turned up in strange places. While they slept, a plaster column in the kitchen smashed as if hit by a baseball bat, and also while they slept, their phones called people.

Although they are not religious, in May they asked a minister to bless the house, but after he left, events escalated further. Their cellphones started beeping, indicating there was no signal. Chapman felt that she was being watched and had an overwhelming sense of foreboding.

That night Chapman took Adrian and then-five-month-old Locklyn and went to stay with her mother, who lived a few blocks away. MacLeod initially refused to join them, but just a few hours later, when the furniture started moving and he heard what sounded like a woman screaming when he picked up the telephone, he also left, she says.

Since they moved, neighbours have called them to report lights going on and off in the securely locked home and on one occasion, the hard-wired fire alarms started beeping, although they were disconnected and didn't have battery backup, she says.

Chapman expected her story to be dismissed as unbelievable, but when she started asking around town, she soon discovered the house had a reputation for strange occurrences dating back decades.

"It seems that everyone knew but us," she says.

Chapman's research at the Grey County records office indicates that at least two men died in the home, one who suffered from sleep apnea and choked to death in his sleep, and another who committed suicide in the living room. The county paper records, which go back to 1945, indicate the house has changed hands numerous times, with people rarely staying for more than 12 months, she says.

"That's really odd, because in 1945 people usually bought a home and lived in it for life," she says.

It doesn't take long to discover that, just as Chapman asserts, the house does have a reputation for being haunted. A few inquiries at the local coffee shop turned up several tales of the unexplained, relating to the house, but no one wanted to be quoted.

Meanwhile, Chapman and MacLeod have put the house up for sale for $184,900 in the hopes of breaking even after legal and realtor fees, but so far, prospective purchasers have lost interest once the realtor advises them that the house is haunted, Chapman says.

Legal expert and Star columnist Bob Aaron says that with the exception of Quebec – which has laws requiring disclosure of property stigma – rules for the rest of Canada are weak.

"In general, the rule is caveat emptor, or buyer beware," he says.

Chapman and MacLeod's realtor, Murray Petch, a broker at Wilfred McIntee & Co. Ltd. in Meaford, confirms in a telephone call that he advises potential purchasers there have been reports of paranormal activity in the house.

"I wasn't aware of it, but now I know, I'm obliged to tell," he says. "But it's okay, there are people who say moving into a haunted house wouldn't bother them at all."

If you’re thinking of making a move and would like to know how we can help, feel free to contact us for more info.

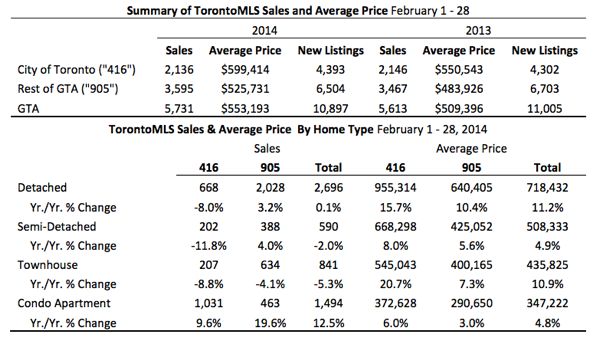

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

Following is TREB’s market report for February 2014: Toronto Real Estate Board President Dianne Usher announced that February 2014 home sales reported by Greater Toronto Area REALTORS® were up by 2.1 per cent compared to the same period last year.

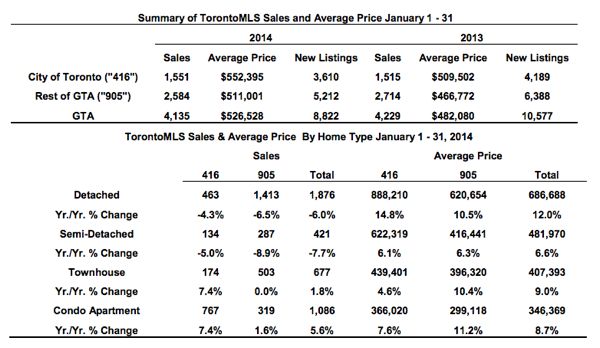

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

Following is TREB’s market report for January 2014: Home ownership in the Greater Toronto Area remains affordable and there are many people looking to purchase a home.

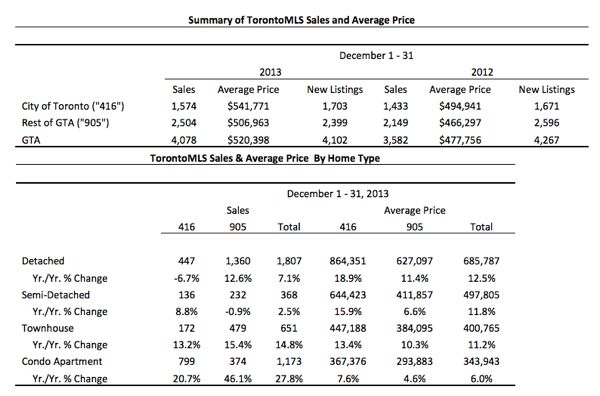

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

Following is TREB’s market report for December 2013: Greater Toronto Area REALTORS® reported 4,078 residential transactions through the TorontoMLS system in December 2013 – up by almost 14 per cent compared to 3,582 sales reported in December 2012.

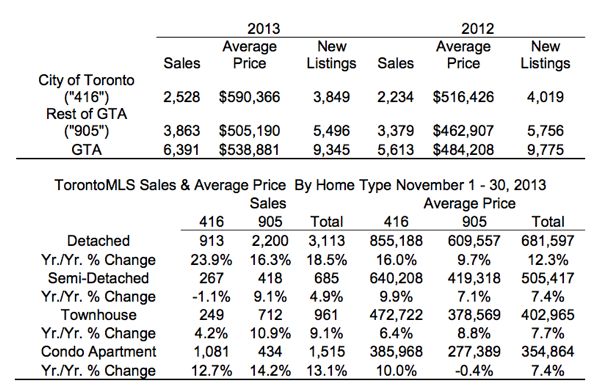

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

Following is TREB’s market report for November 2013: Greater Toronto Area REALTORS® reported 6,391 residential sales through the TorontoMLS system in November, representing a 13.9 per cent increase over the sales result for November 2012.

If you want to get the best price for your home, should you:

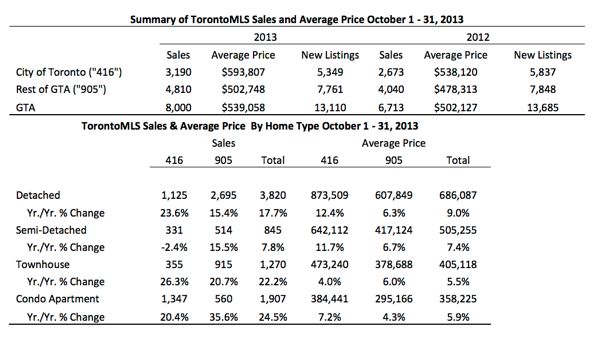

If you want to get the best price for your home, should you: Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

Following is TREB’s market report for October 2013: Greater Toronto Area REALTORS® reported 8,000 home sales through the TorontoMLS system in October 2013 – up from 6,713 transactions reported in October 2012. Over the same period, new listings on the TorontoMLS system were down.

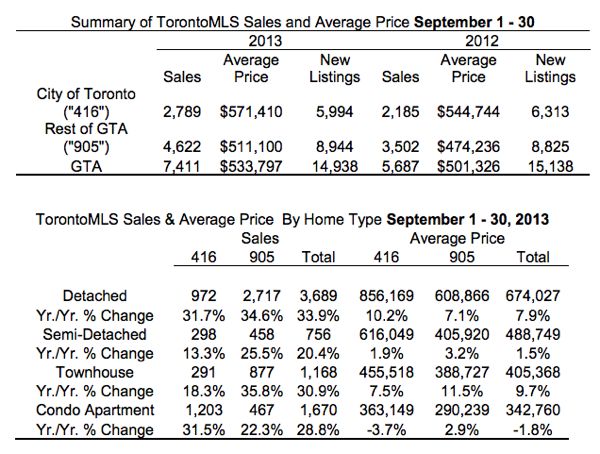

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

t

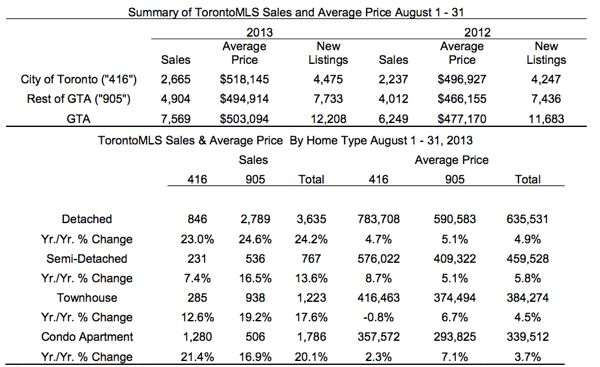

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

t

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

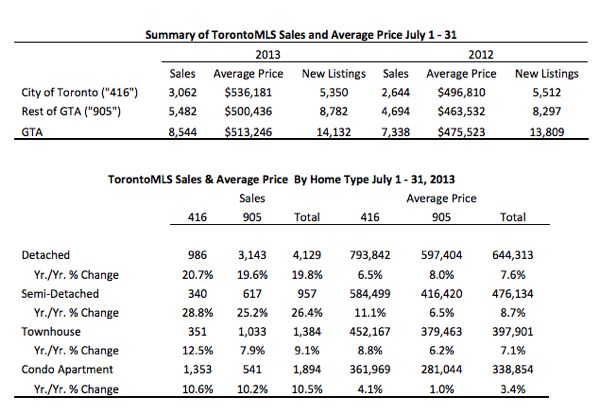

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

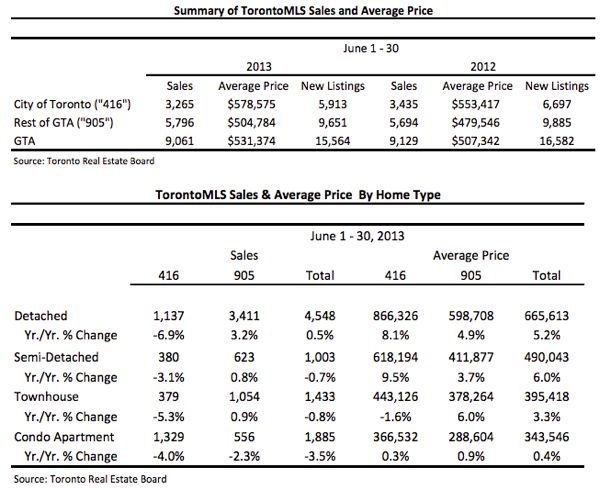

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

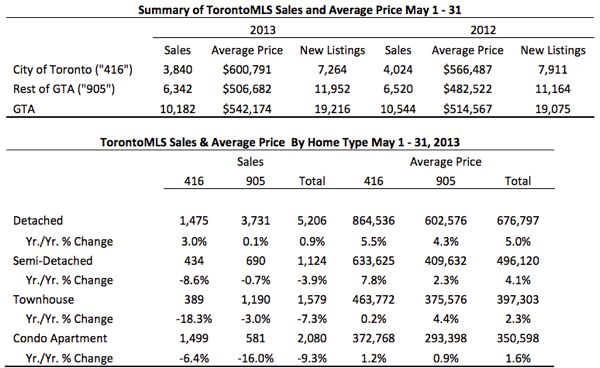

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

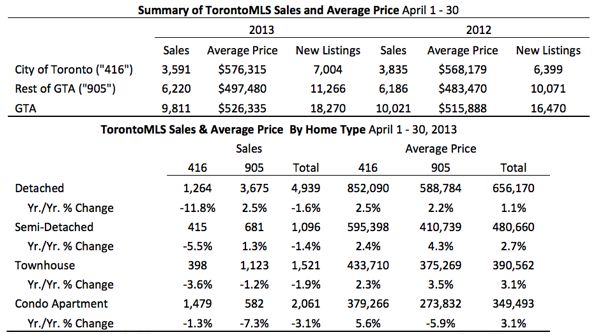

Following is TREB’s market report for April 2013: Greater Toronto Area REALTORS® reported 9,811 sales through the TorontoMLS system in April 2013, representing a dip of two per cent in comparison to 10,021 transactions in April 2012. Both new listings during the month and active listings at the end of April were up on a year-over-year basis.

Following is TREB’s market report for April 2013: Greater Toronto Area REALTORS® reported 9,811 sales through the TorontoMLS system in April 2013, representing a dip of two per cent in comparison to 10,021 transactions in April 2012. Both new listings during the month and active listings at the end of April were up on a year-over-year basis.

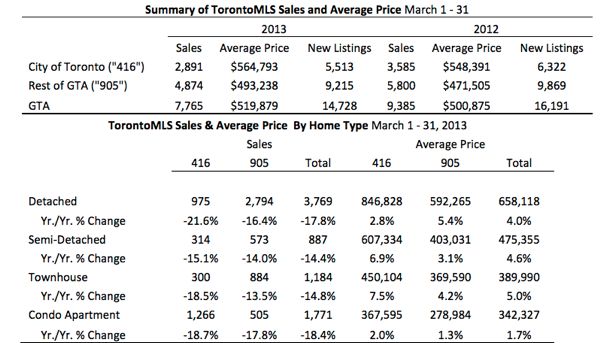

Following is TREB’s market report for March 2013: Greater Toronto Area REALTORS® reported 7,765 transactions through the TorontoMLS system in March 2013 – down 17 per cent compared to 9,385 transactions in March 2012.

Following is TREB’s market report for March 2013: Greater Toronto Area REALTORS® reported 7,765 transactions through the TorontoMLS system in March 2013 – down 17 per cent compared to 9,385 transactions in March 2012.

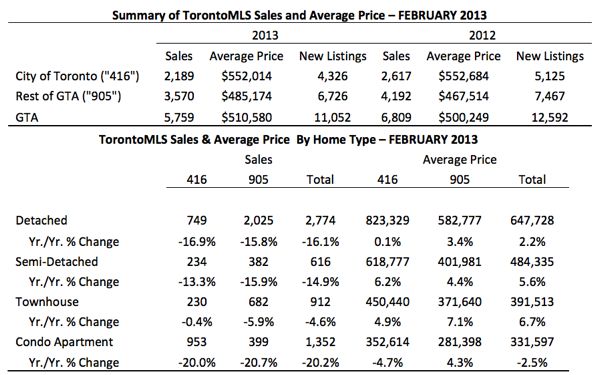

Following is TREB’s market report for February 2013: Greater Toronto Area (GTA) REALTORS® reported 5,759 sales through the TorontoMLS system in February 2013 – a decline of 15 per cent in comparison to February 2012. It should be noted that 2012 was a leap year with one extra day in February. A 28 day year-over-year sales comparison resulted in a lesser decline of 10.5 per cent.

Following is TREB’s market report for February 2013: Greater Toronto Area (GTA) REALTORS® reported 5,759 sales through the TorontoMLS system in February 2013 – a decline of 15 per cent in comparison to February 2012. It should be noted that 2012 was a leap year with one extra day in February. A 28 day year-over-year sales comparison resulted in a lesser decline of 10.5 per cent.

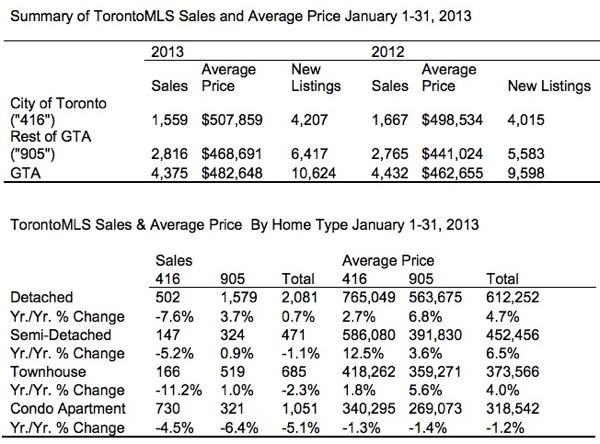

Following is TREB’s market report for January 2013: Greater Toronto Area REALTORS® reported 4,375 transactions through the TorontoMLS system in January 2013. This number represented a slight decline compared to 4,432 transactions reported in January 2012.

Following is TREB’s market report for January 2013: Greater Toronto Area REALTORS® reported 4,375 transactions through the TorontoMLS system in January 2013. This number represented a slight decline compared to 4,432 transactions reported in January 2012.

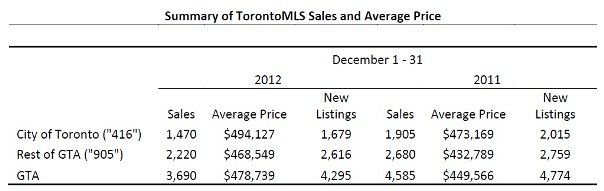

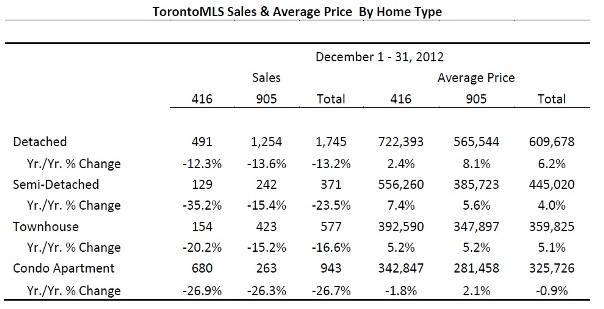

Following is TREB’s market report for December 2012: Greater Toronto Area REALTORS® reported 3,690 sales through the TorontoMLS system in December 2012 – down from 4,585 sales in December 2011. Total sales for 2012 amounted to 85,731 – down from 89,096 transactions in 2011.

Following is TREB’s market report for December 2012: Greater Toronto Area REALTORS® reported 3,690 sales through the TorontoMLS system in December 2012 – down from 4,585 sales in December 2011. Total sales for 2012 amounted to 85,731 – down from 89,096 transactions in 2011.

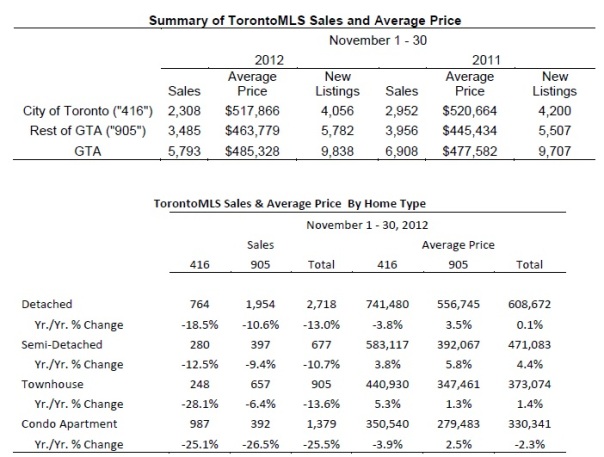

Following is TREB’s market report for November 2012: Toronto Area REALTORS® reported 5,793 sales in November 2012 – down by 16 per cent compared to November 2011.

Following is TREB’s market report for November 2012: Toronto Area REALTORS® reported 5,793 sales in November 2012 – down by 16 per cent compared to November 2011.

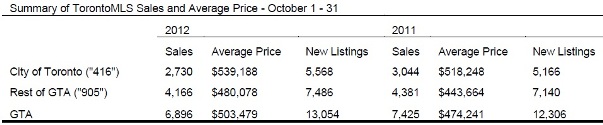

Following is TREB’s market report for October 2012: Greater Toronto Area REALTORS® reported 6,896 transactions through the TorontoMLS system in October 2012 – a decrease of 7.1 per cent compared to October 2011. There were two more business days in October 2012 versus October 2011. On a per business day basis, transactions were down by 15.6 per cent.*

Following is TREB’s market report for October 2012: Greater Toronto Area REALTORS® reported 6,896 transactions through the TorontoMLS system in October 2012 – a decrease of 7.1 per cent compared to October 2011. There were two more business days in October 2012 versus October 2011. On a per business day basis, transactions were down by 15.6 per cent.*

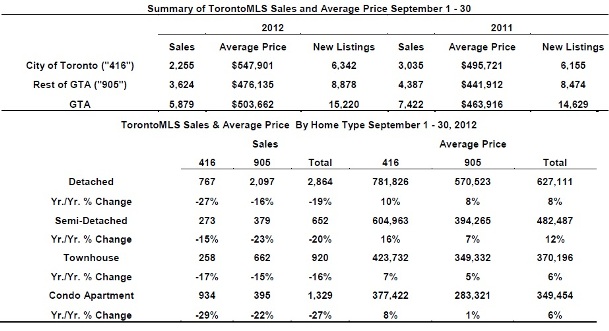

Following is TREB’s market report for September 2012: Greater Toronto Area (GTA) REALTORS® reported 5,879 transactions through the TorontoMLS system in September 2012. The average selling price for these transactions was $503,662, representing an increase of more than 8.5 per cent compared to last year.

Following is TREB’s market report for September 2012: Greater Toronto Area (GTA) REALTORS® reported 5,879 transactions through the TorontoMLS system in September 2012. The average selling price for these transactions was $503,662, representing an increase of more than 8.5 per cent compared to last year.