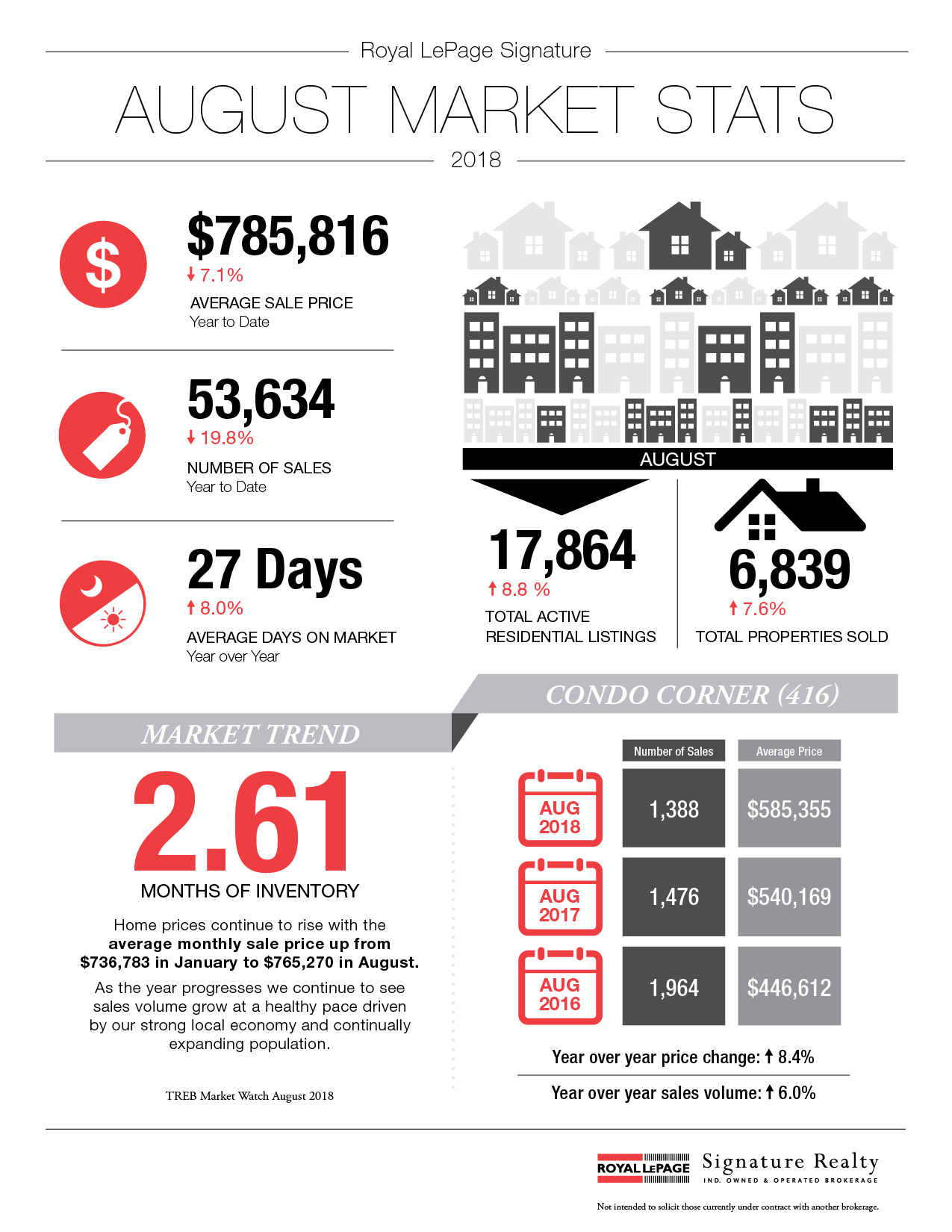

August 2018 market stats are here!

The average sale price for the month was $765,270, up 4.7% compared to August 2017.

Here’s a breakdown of the average sale prices & year-over-year increases/decreases for the 416 area code:

Detached = $1,244,275 (+4.9%)

Semi-Detached = $891,208 (-0.5%)

Townhouse = $683,160 (-0.1%)

Condo Apartment = $585,355 (+8.3%)

And here’s TREB’s official market report for the month of August 2018:

Toronto Real Estate Board President Garry Bhaura announced sales and price increases on a year-over-year basis in August.

Greater Toronto Area REALTORS® reported 6,839 sales through TREB’s MLS® System in August 2018 – an 8.5 per cent increase compared to August 2017.

Both the average selling price, at $765,270, and the MLS® Home Price Index Composite Benchmark for August 2018 were up compared to the same month in 2017, by 4.7 per cent and 1.5 per cent respectively.

The average selling price increased by more than the MLS® HPI Composite due, at least in part, to a change in the mix of sales compared to last year.

Detached home sales were up by double digits on a year-over-year percentage basis – substantially more than many other less-expensive home types.

“It is encouraging to see a continued resurgence in the demand for ownership housing. Many home buyers who had initially moved to the sidelines due to the Ontario Fair Housing Plan and new mortgage lending guidelines have renewed their search for a home and are getting deals done much more so than last year. In a region where the economy remains strong and the population continues to grow, ownership housing remains a solid long-term investment,” said Mr. Bhaura.

Month-over-month sales and price growth also continued in August.

On a preliminary seasonally adjusted basis, August 2018 sales were up by two per cent compared to July 2018.

The seasonally adjusted August 2018 average selling price was down slightly by 0.2 per cent compared to July 2018, following strong monthly increases in May, June and July.

“Market conditions in the summer of 2018, including this past August, were tighter than what was experienced in the summer of 2017. In August, the annual rate of sales growth outpaced the annual rate of new listings growth. We only have slightly more than two-and-a-half months of inventory in the TREB market area as a whole and less than two months of inventory in the City of Toronto. This means that despite the fact the sales remain off the record highs from 2016 and 2017, many GTA neighbourhoods continue to suffer from a lack of inventory. This could present a problem if demand continues to accelerate over the next year, which is expected,” said Jason Mercer, TREB’s Director of Market Analysis.

If you’re thinking of making a move and would like to know how we can help, please contact us for more info.

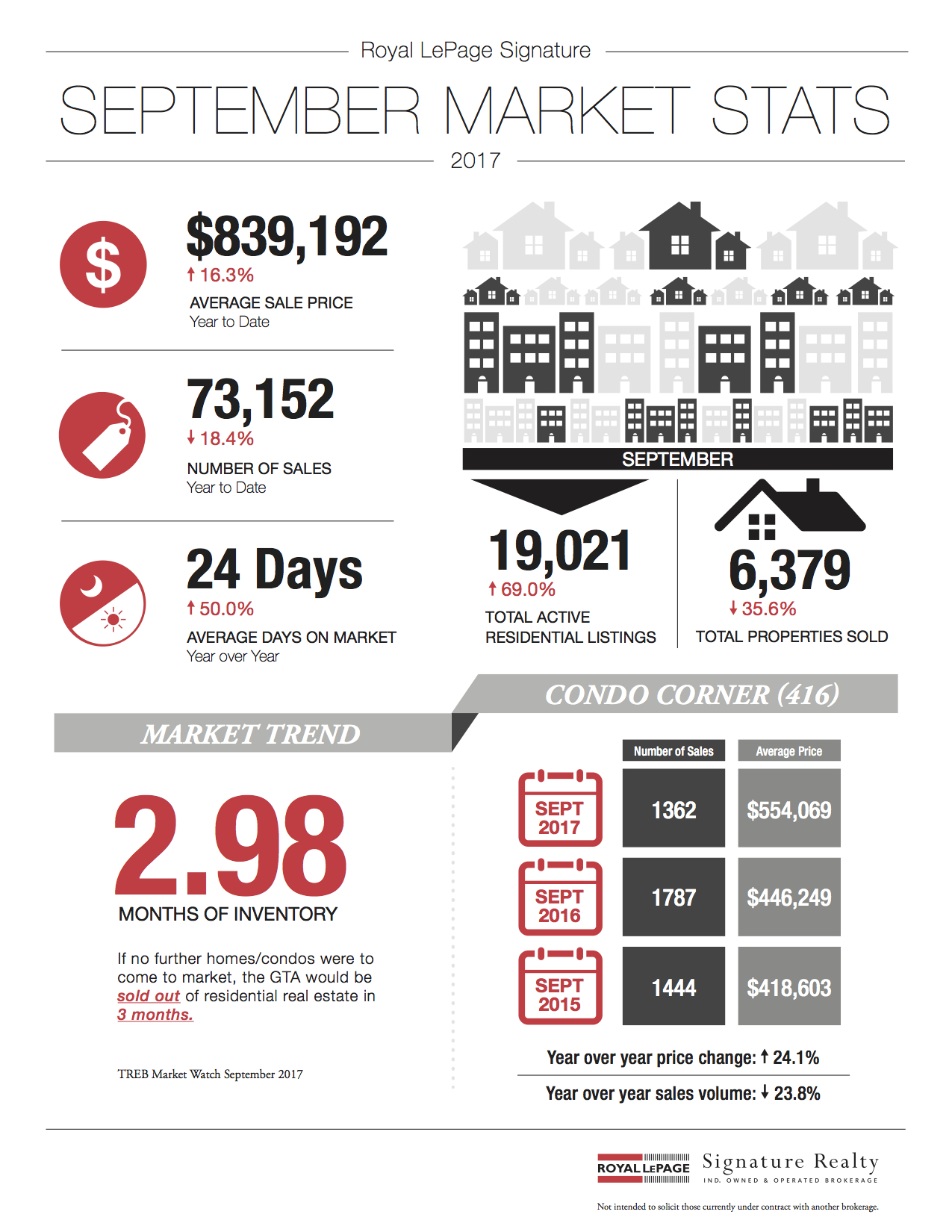

September 2017 market stats are here!

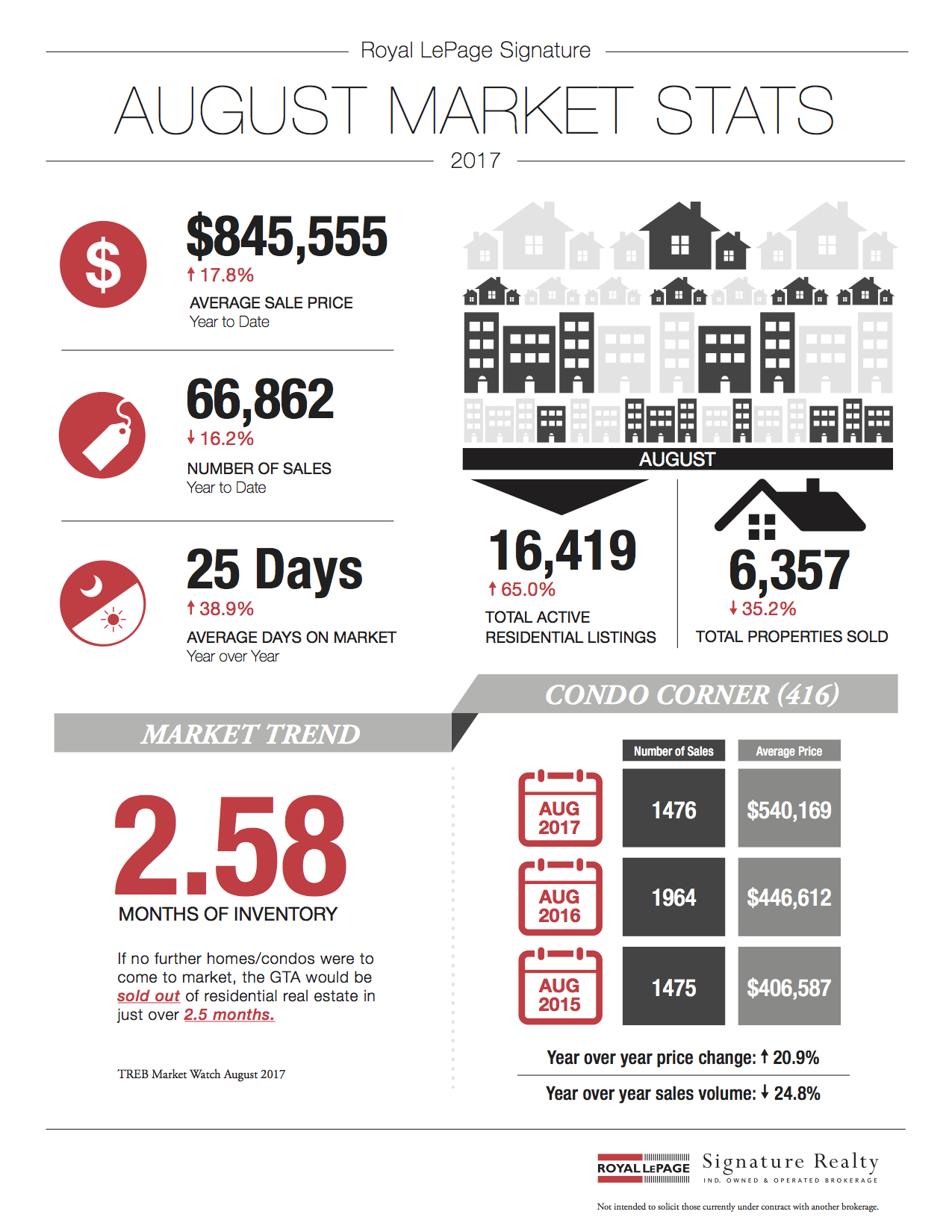

September 2017 market stats are here! Following is TREB’s market report for August 2017:

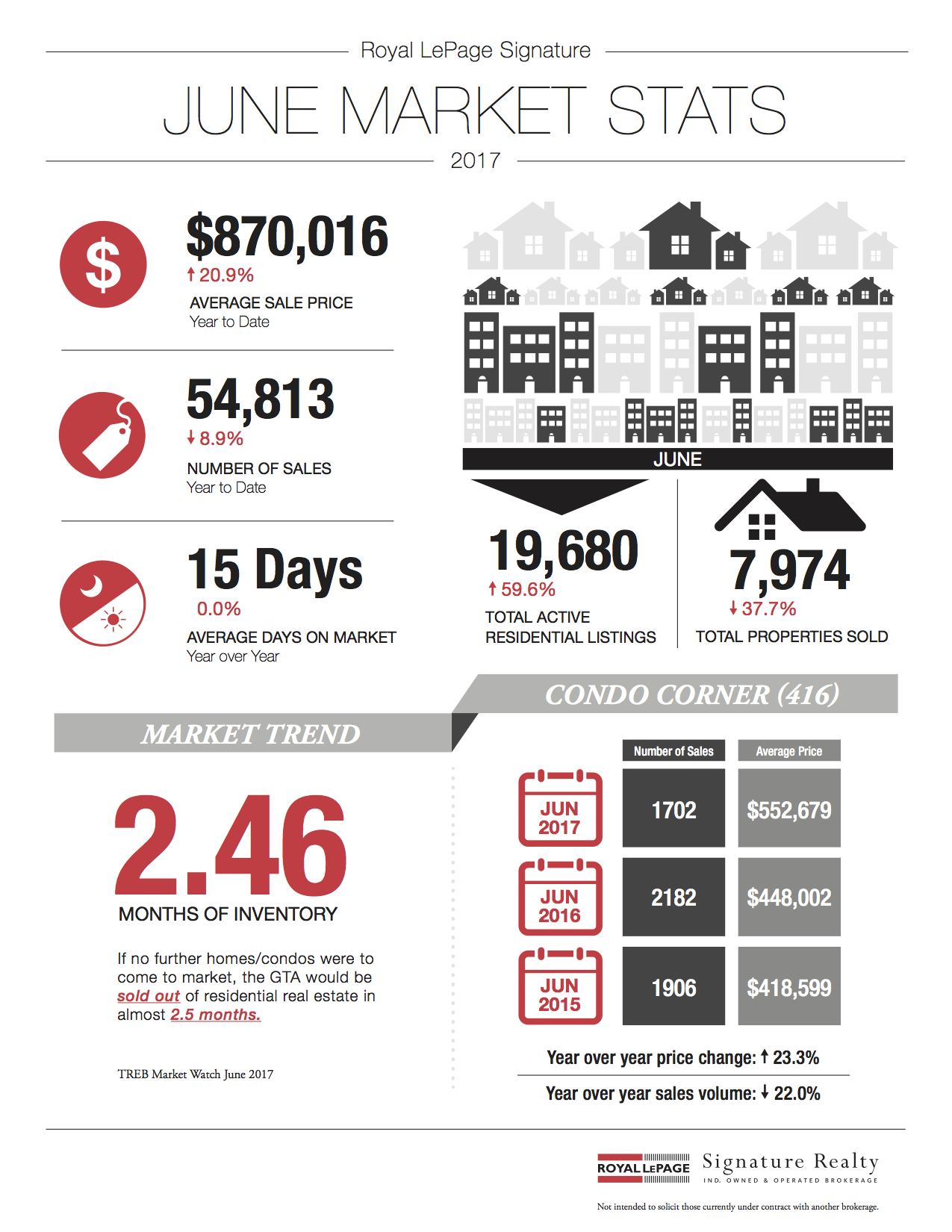

Following is TREB’s market report for August 2017: Following is TREB’s market report for June 2017:

Following is TREB’s market report for June 2017: Following is TREB’s market report for April 2017:

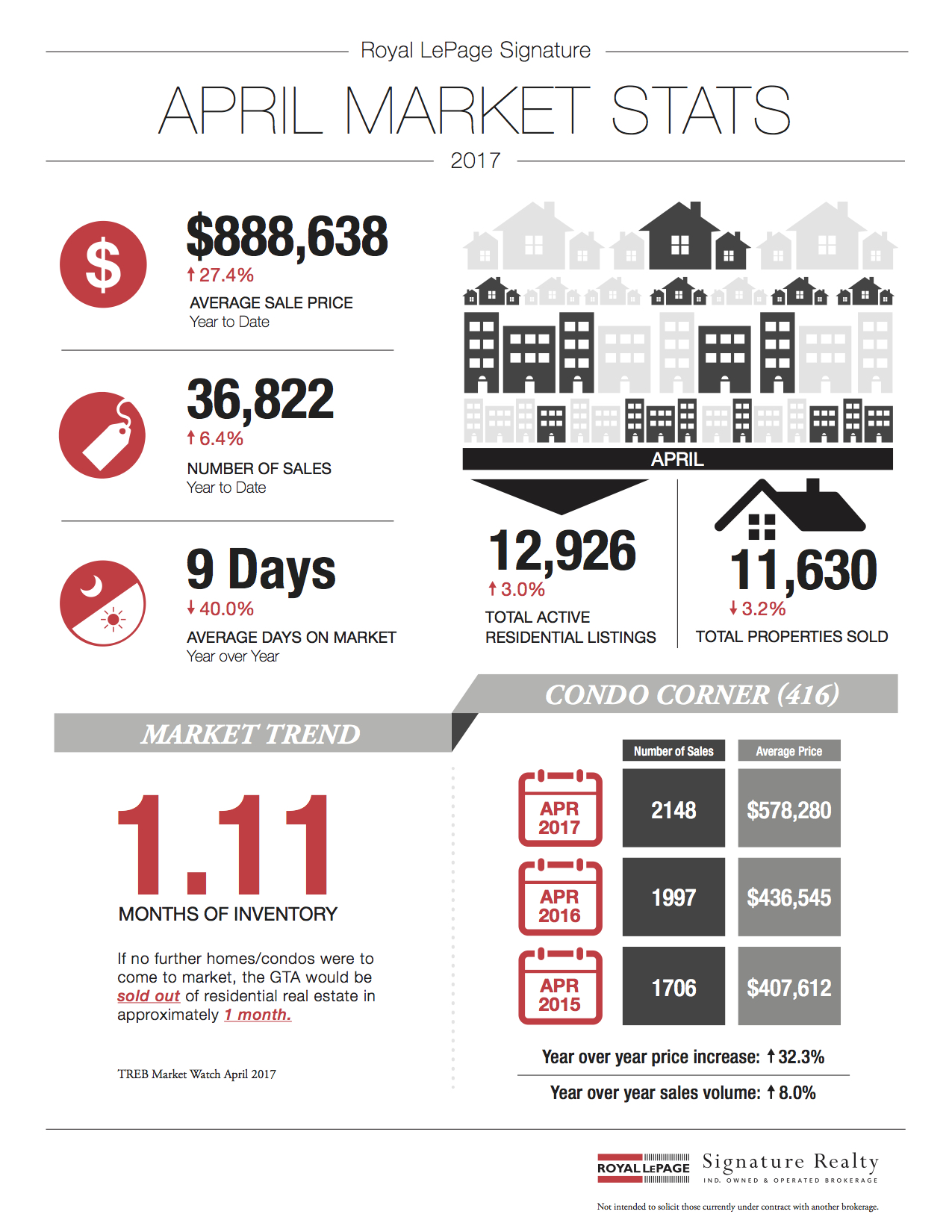

Following is TREB’s market report for April 2017:

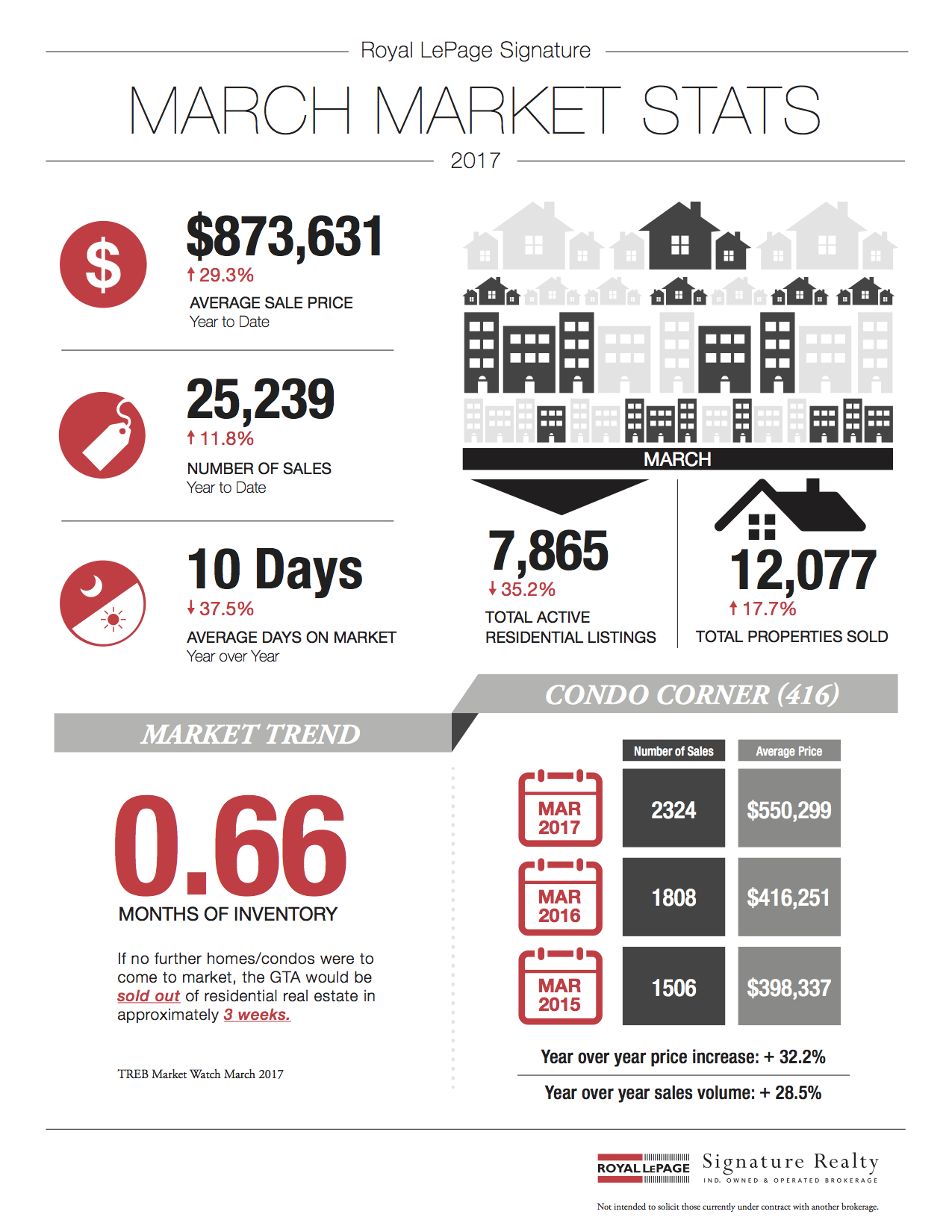

Following is TREB’s market report for March 2017:

Following is TREB’s market report for March 2017: Following is TREB’s market report for February 2017:

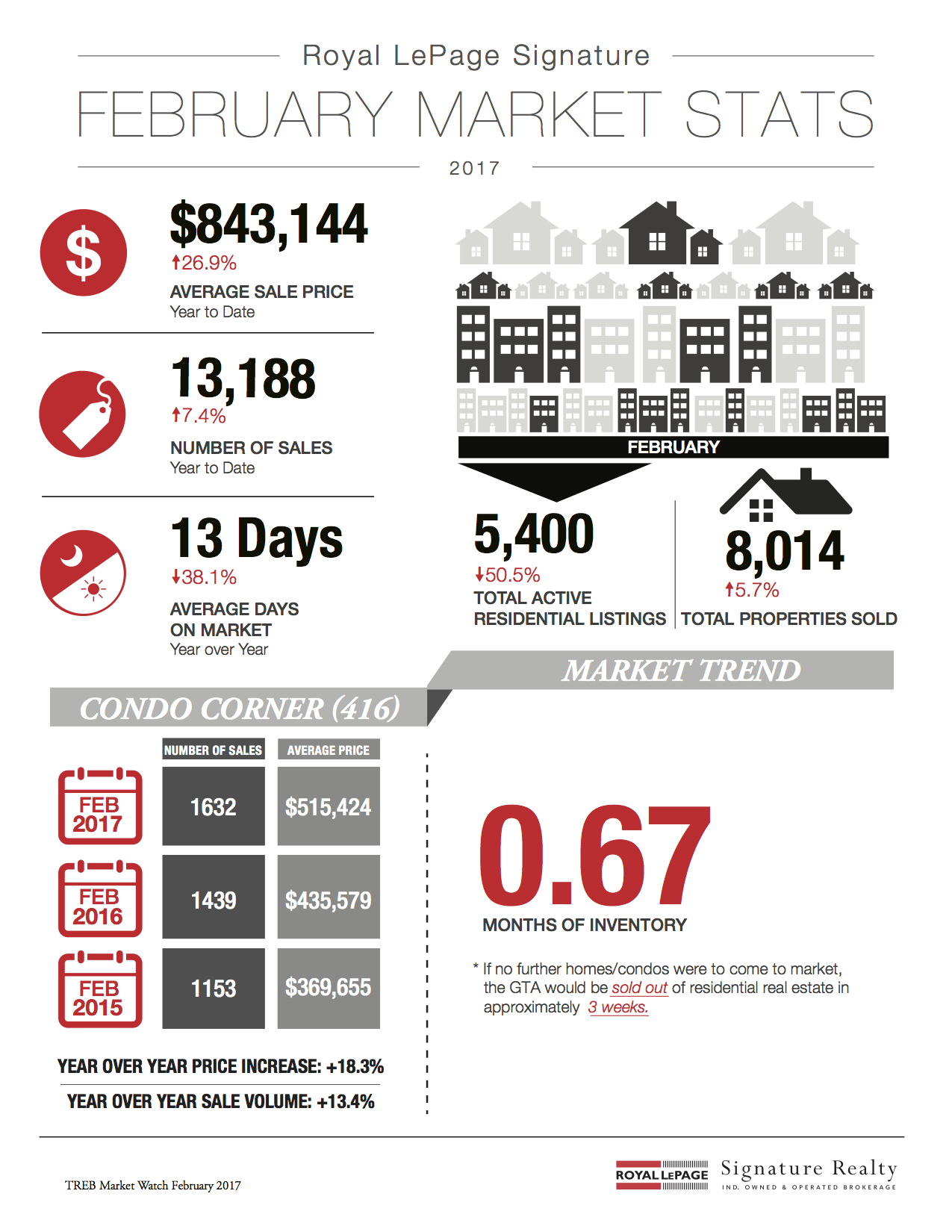

Following is TREB’s market report for February 2017: Following is TREB’s market report for January 2017:

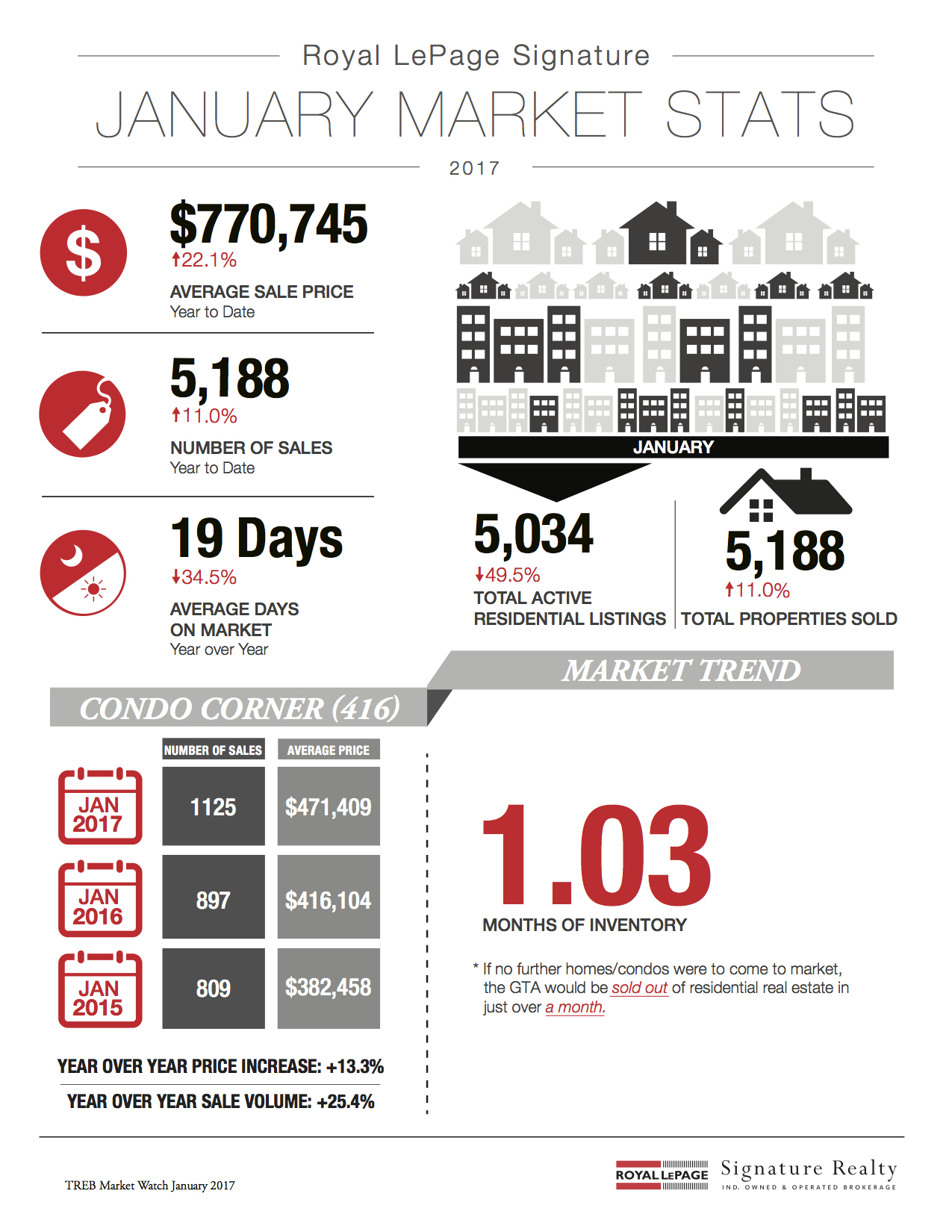

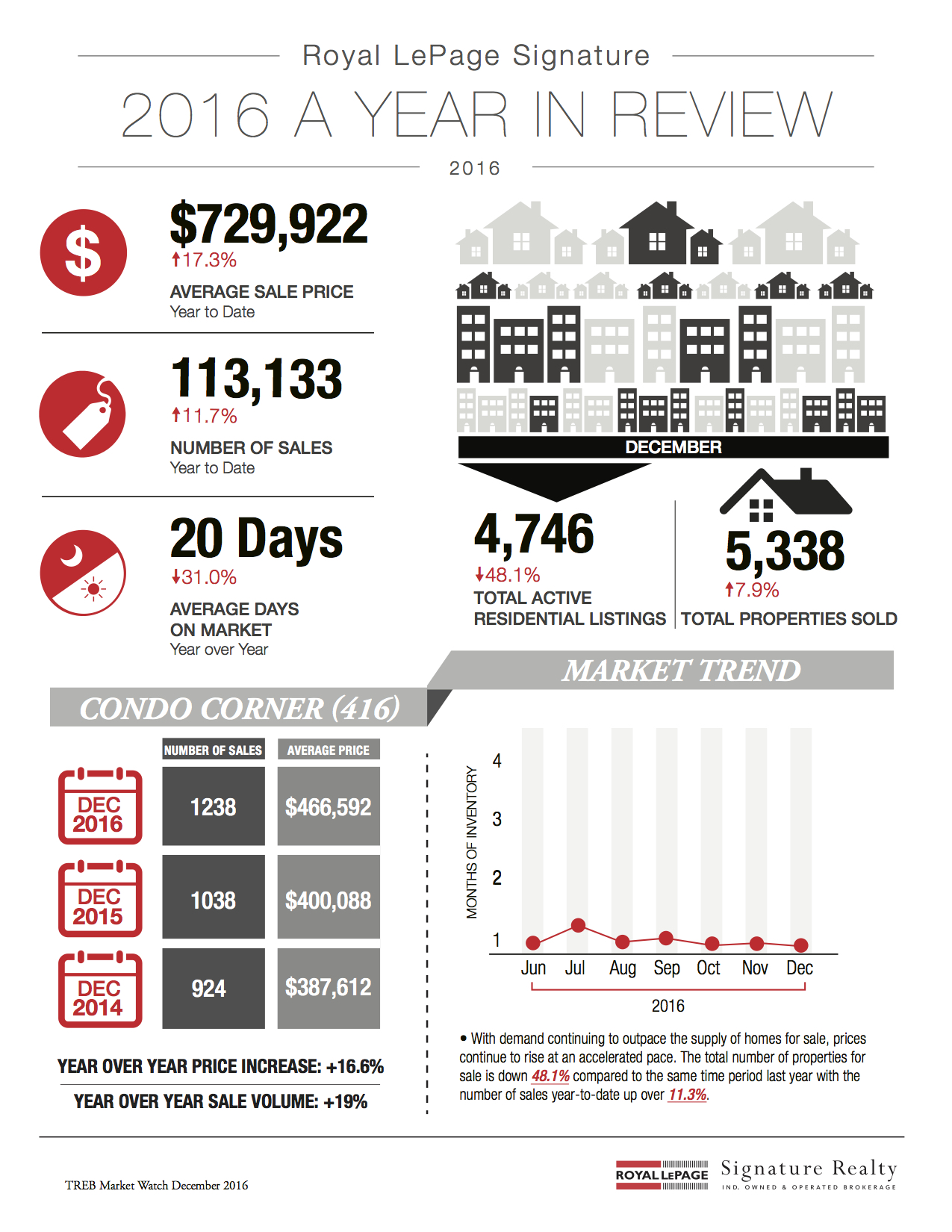

Following is TREB’s market report for January 2017: Following is TREB’s market report for the year 2016:

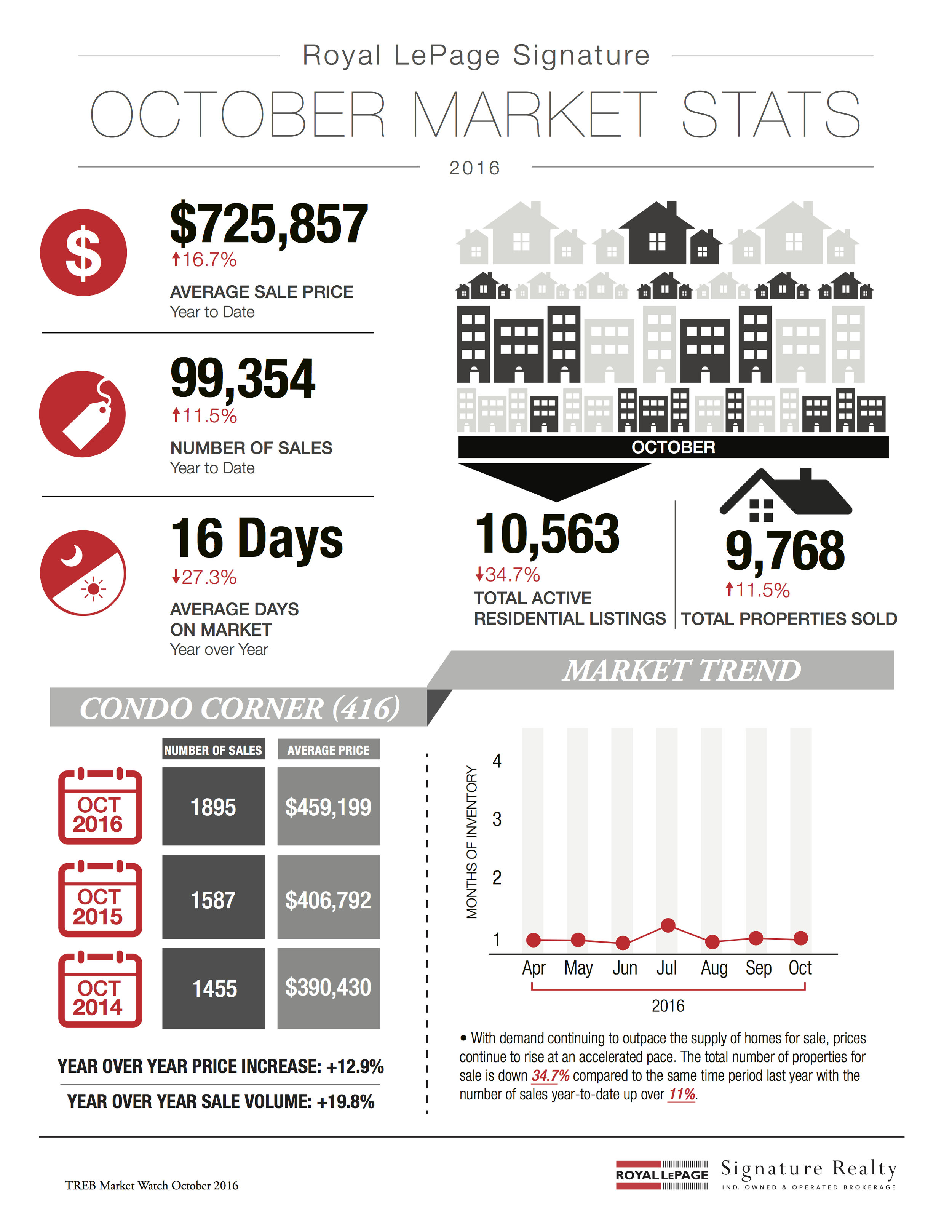

Following is TREB’s market report for the year 2016: Following is TREB’s market report for October 2016:

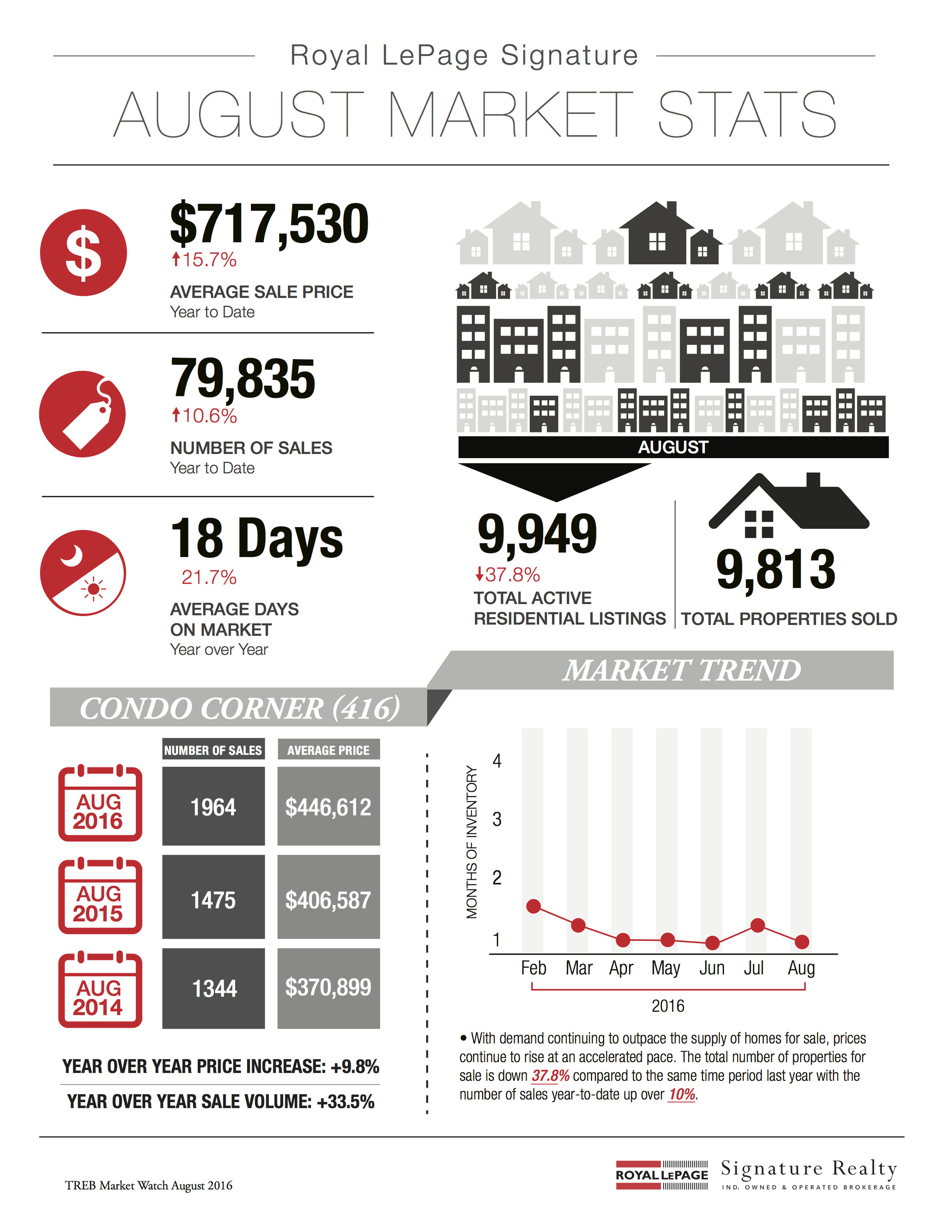

Following is TREB’s market report for October 2016: Following is TREB’s market report for August 2016:

Following is TREB’s market report for August 2016: