Since last week’s announcement by the Office of the Superintendent of Financial Institutions (OSFI) about the upcoming changes to the Canadian mortgage rules, I’ve seen plenty of buyers fret that their budgets are going to be reduced by as much as 20%.

This isn’t necessarily the case though, and not every buyer needs to stress about the new stress test. Let’s recap what sort of changes are coming once the new rules are implemented on January 1st, 2018.

The Biggest Change

Once the new rules come into play no-one will be able to qualify at less than the benchmark rate (which today is set at 4.89%). And in fact, borrowers with a down payment of more than 20% will have to qualify at either the benchmark rate or their contract rate + 2%, whichever is greater. So it’s quite possible that some borrowers will have to qualify at a rate that is greater than the current benchmark rate of 4.89%!

To give you some perspective: Since the last round of mortgage rule changes came into effect last year, only default-insured borrowers (these borrowers typically have a down payment of less than 20%) have had to qualify at the benchmark rate.

Borrowers with a down payment of more than 20% (and not default-insured) have had the benefit of only needing to qualify at their contract rate (which is typically less than the benchmark rate).

Come January 1st 2018 though, all borrowers, regardless of their down payment amount and regardless of whether or not their mortgage is default-insured, will have to qualify at the benchmark rate (or possibly higher).

Not Everyone Will Actually Be Affected

I’ve spoken to a handful of buyer clients this past week (after urging them to check-in with their mortgage broker regarding the new rules), and all of them are happy to report back that they will not be affected.

Why not?Because not every borrower pushes their mortgage amount to the maximum.

For example, if a buyer qualifies for a maximum purchase price of $1,000,000 but only plans on spending a maximum of $800,000, then they won’t actually be affected by the new rules.

Buyers are often approved for mortgages that are significantly higher than what they actually want to spend. I’ve worked with plenty of buyers who are simply amazed at how much the bank will lend them and have no intention of going anywhere near that maximum number.

Some will certainly be affected by the new rules though. Specifically those who do need to push their mortgage amount to the maximum.

Consider first time buyers, for example. They have no home equity to throw into the pot, and rely only on whatever down payment they have saved. These buyers would typically need to push their mortgage amount to the maximum in order to break into the market.

Will You Be Affected?

At this point, there are still some unanswered questions with regards to the timing of the implementation of the new rules. We’re advising all of our buyer clients to reach-out to their mortgage brokers immediately to secure financing options before the changes come.

If you have any questions just give give us a shout and we’ll put you in touch with a mortgage specialist who can help.

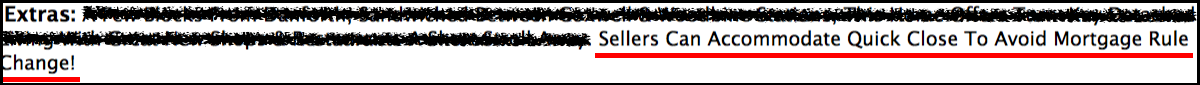

September 2017 market stats are here!

September 2017 market stats are here! Welcome to the leafy green streets of beautiful Roncesvalles!

Welcome to the leafy green streets of beautiful Roncesvalles!

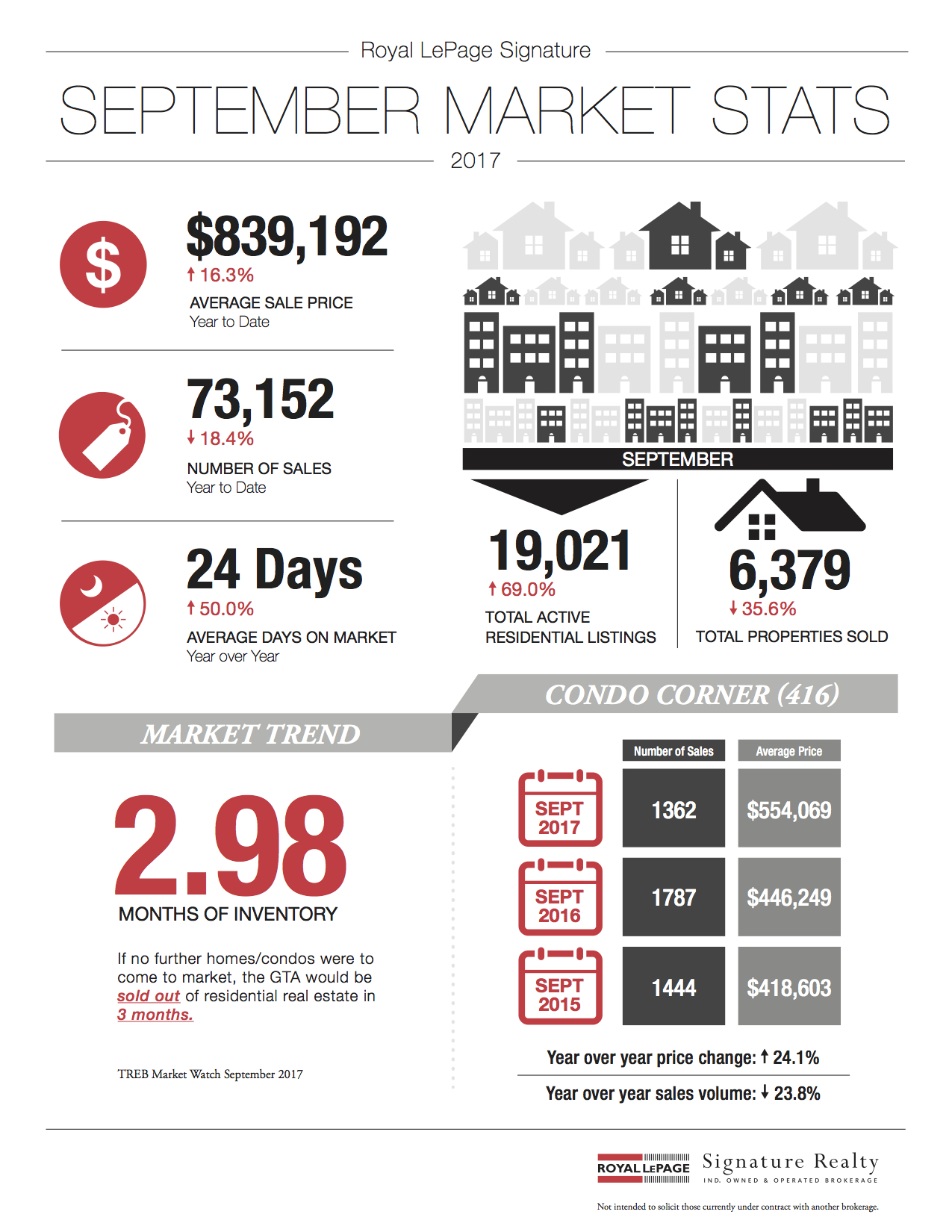

Following is TREB’s market report for August 2017:

Following is TREB’s market report for August 2017:

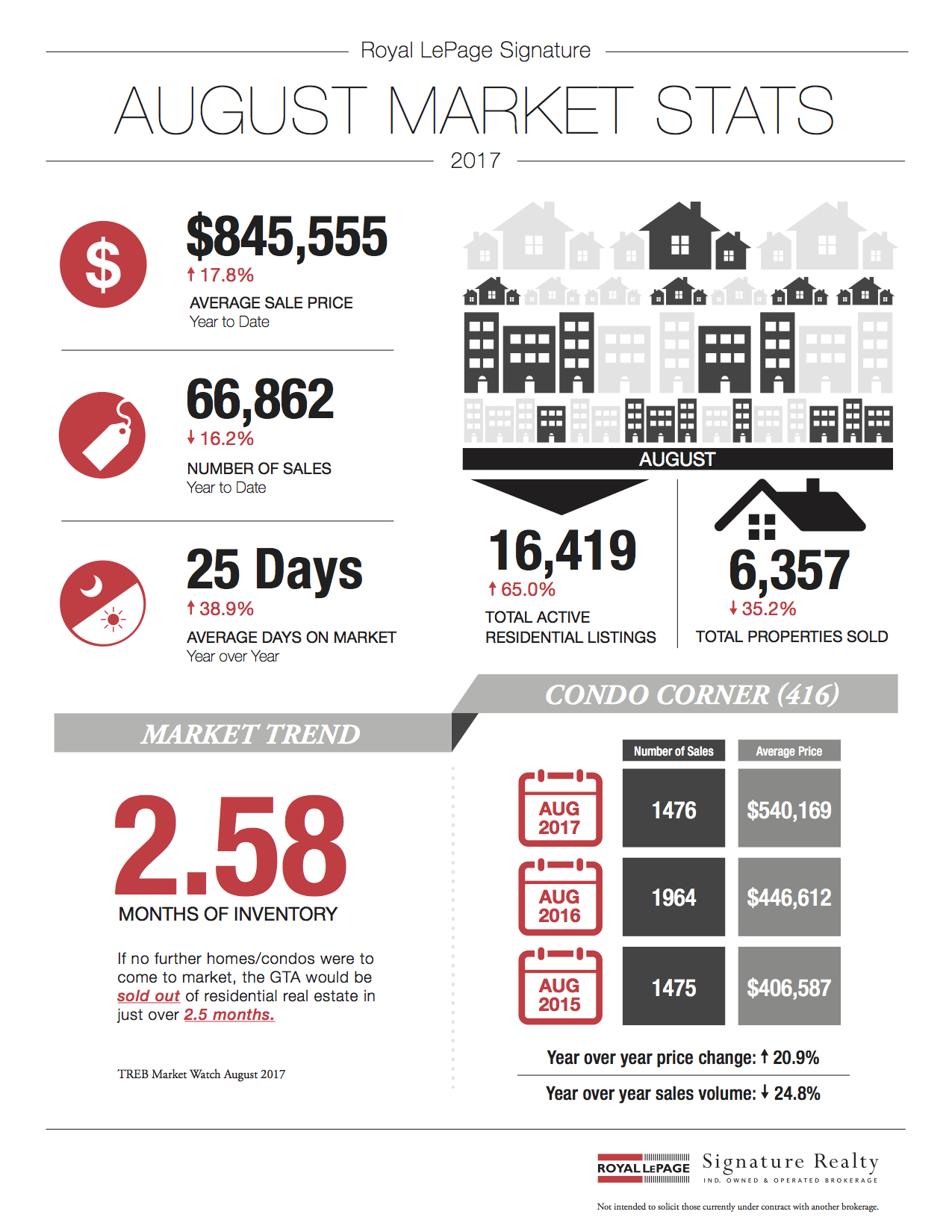

Following is TREB’s market report for June 2017:

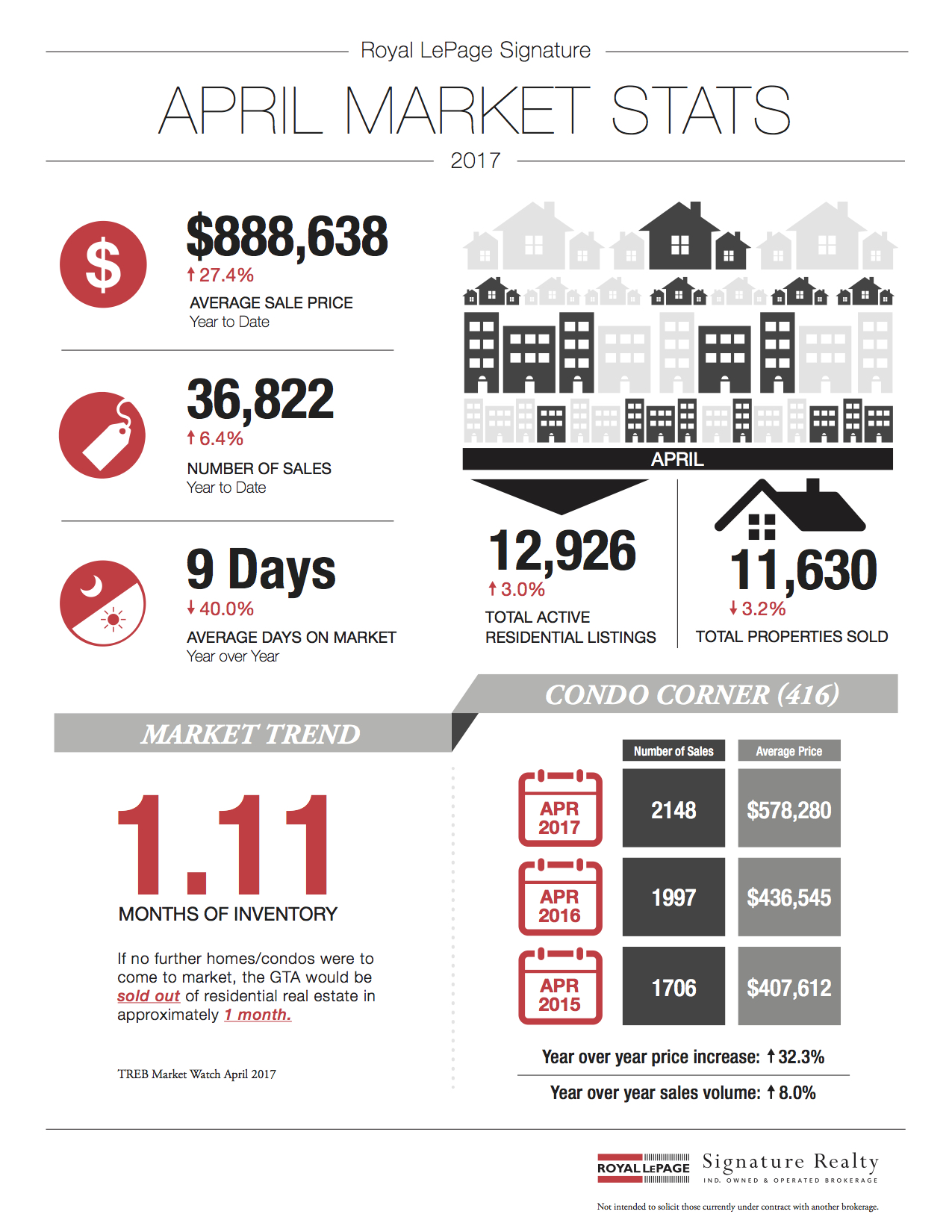

Following is TREB’s market report for June 2017: Following is TREB’s market report for April 2017:

Following is TREB’s market report for April 2017:

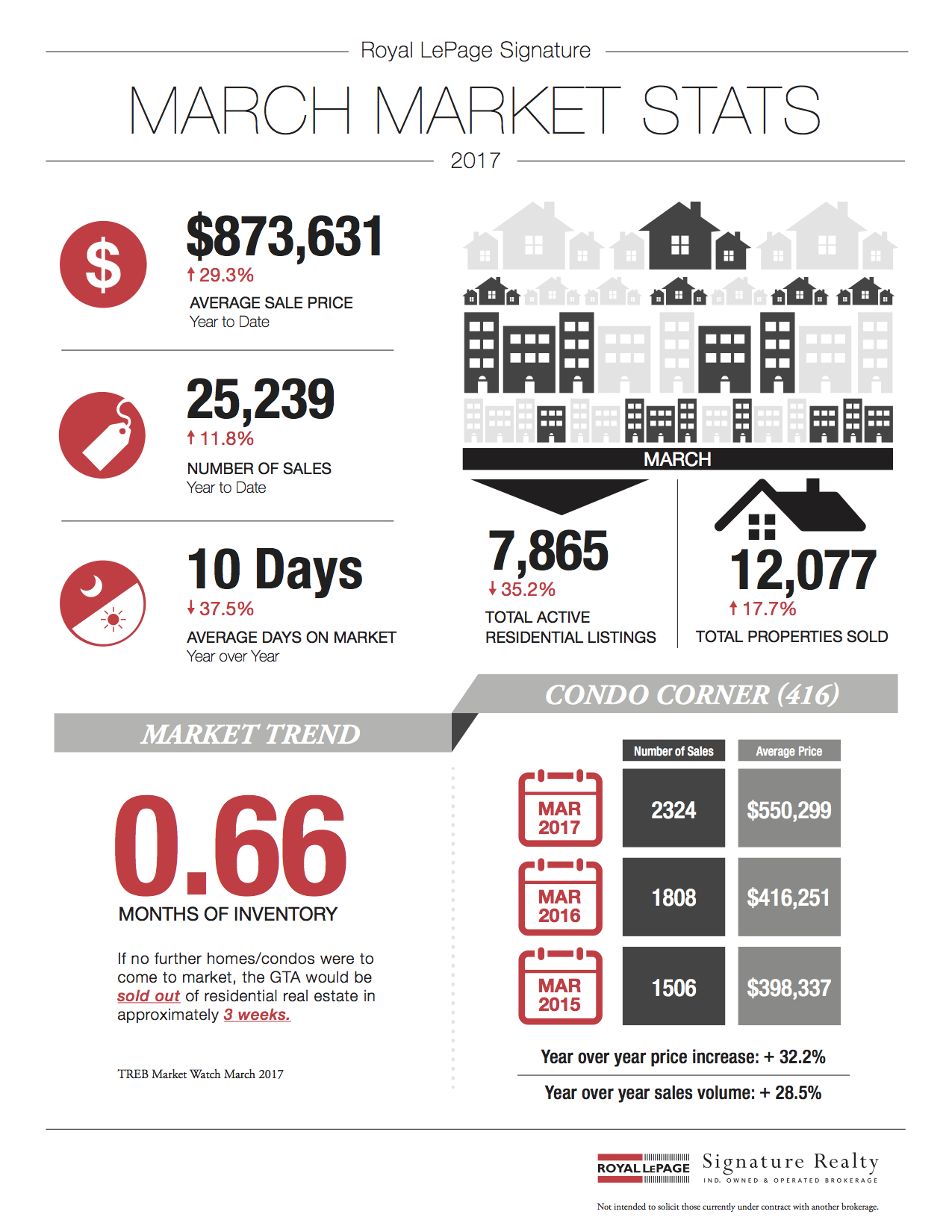

Following is TREB’s market report for March 2017:

Following is TREB’s market report for March 2017:

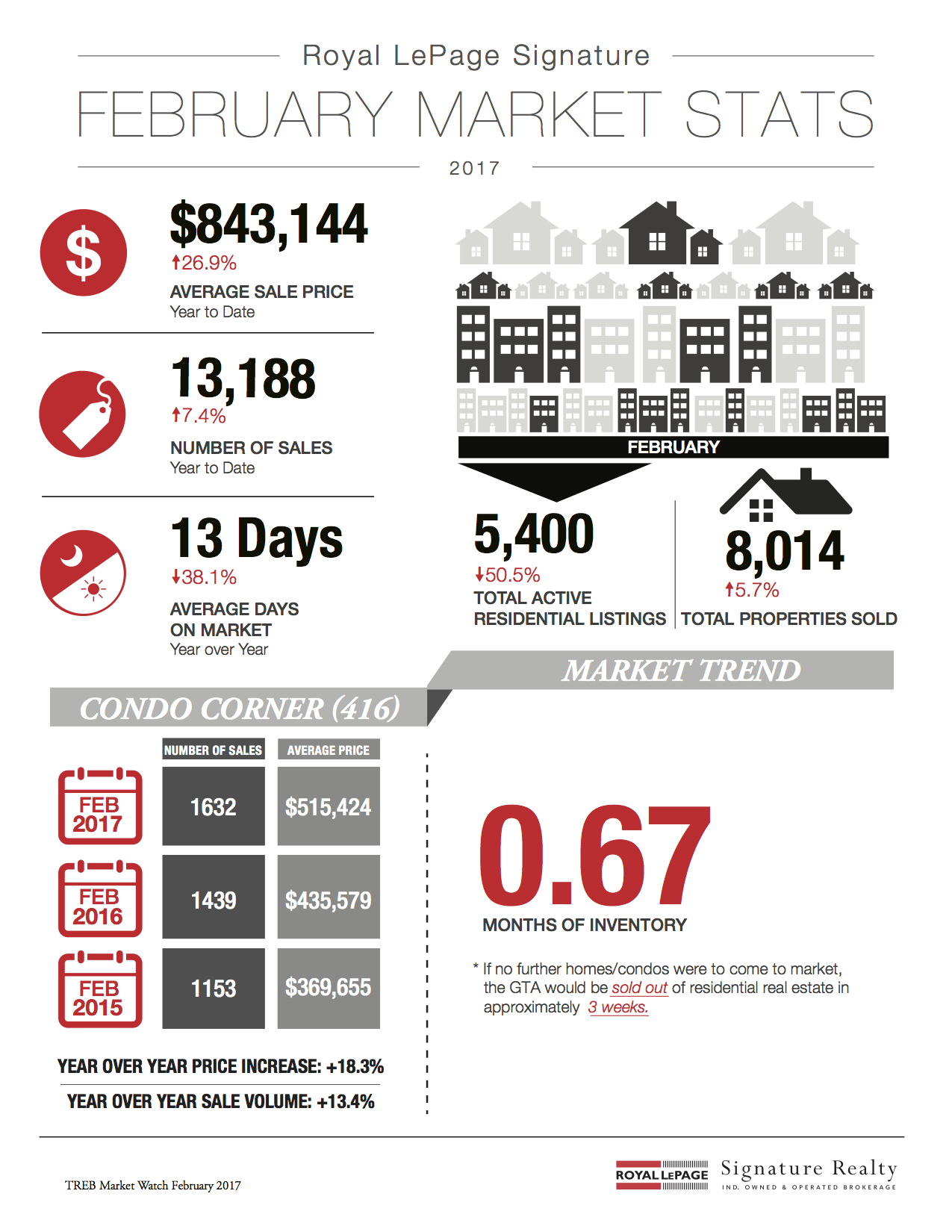

Following is TREB’s market report for February 2017:

Following is TREB’s market report for February 2017:

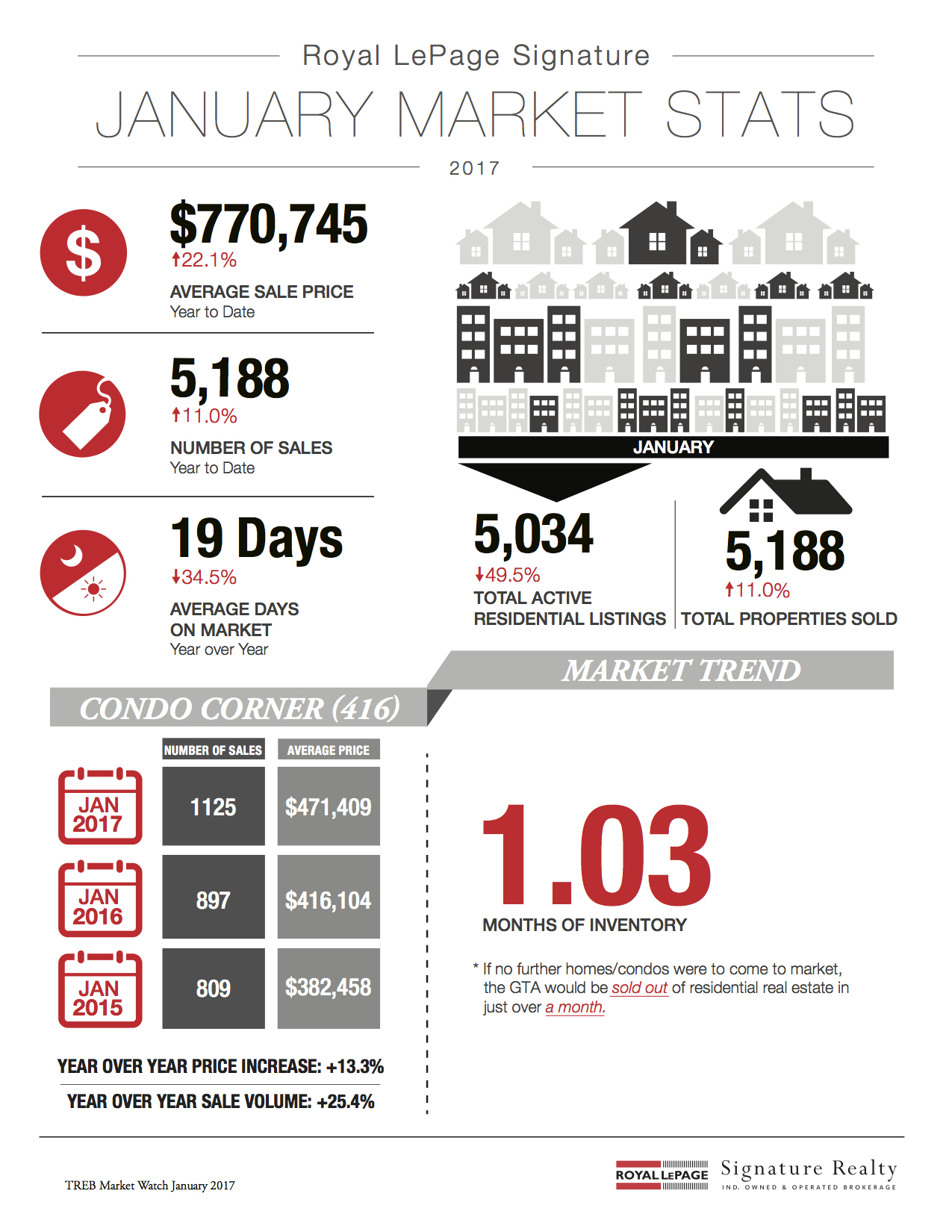

I’ve been a realtor for over 10 years now, and I can honestly say that I’ve never seen as many WTF sale prices as I saw last week.

I’ve been a realtor for over 10 years now, and I can honestly say that I’ve never seen as many WTF sale prices as I saw last week. Following is TREB’s market report for January 2017:

Following is TREB’s market report for January 2017: